For

expositional purposes the following order book scenario will be adopted and the

new and old algorithm applied to determine the call auction price:

Order

book for stock X at the conclusion of the pre-open period

|

Broker |

Quantity |

Bid

|

Ask |

Quantity |

Broker |

|

199 |

500 |

640 |

610 |

1000 |

606 |

|

227 |

500 |

639 |

640 |

500 |

317 |

|

298 |

500 |

639 |

641 |

520 |

150 |

|

288 |

1000 |

634 |

642 |

550 |

203 |

|

144 |

500 |

633 |

643 |

519 |

202 |

Old algorithm -

a weighted average price is calculated

from the last two remaining orders that are matched. This price is based on the

following formula:

((buy

quantity x buy price) + (sell quantity x sell price))/(buy

quantity + sell quantity)

The

last two orders matched in this example consist of a buy order for stock X at

$6.39 (broker 227), with an available quantity of 500 shares and a sell order

for stock X at $6.10 (broker 606) with an available quantity of 500 shares.

This gives an auction price of [((500 x $6.39) + (500 x $6.10))/(500 + 500))] = $6.245. This price is applied to all trades

in the auction.

New algorithm -

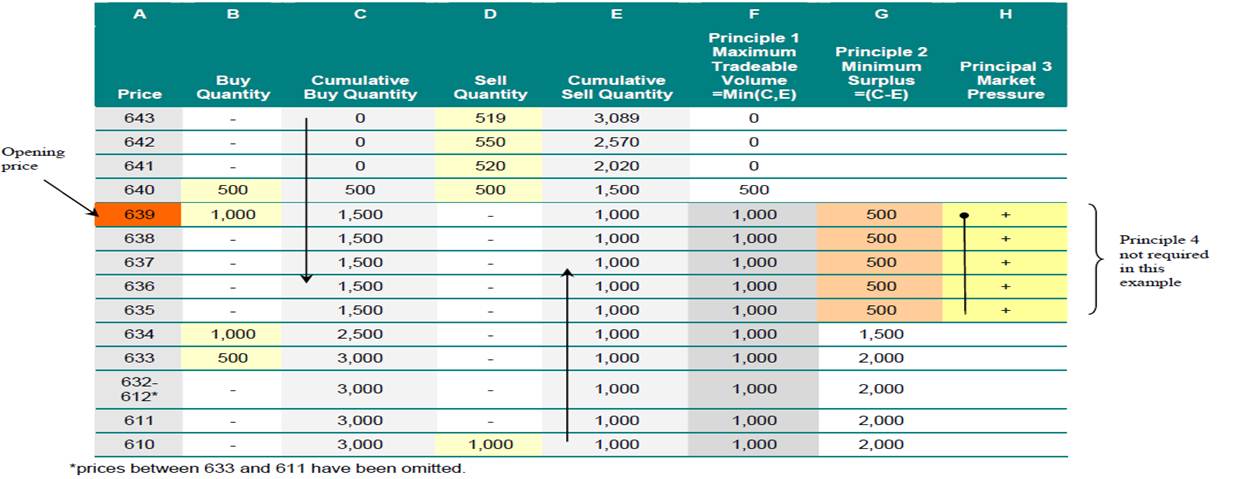

to facilitate the application of the

new algorithm it is useful to reconfigure the example order book by sorting all

prices from highest to lowest. This is presented below. The algorithm is

applied as follows:

Principle 1.

Determine maximum tradeable volume. As

is evident from the above Table, maximum tradeable volume occurs at prices

between $6.10 and $6.39. As there is more than one price that exhibits maximum

tradeable volume of 1,000 shares, we must progress to Principle 2.

Principle 2.

Determine the minimum surplus within

the price range, $6.10 to $6.39, as established in Principle 1. Minimum surplus

occurs at 500 shares at each price from $6.35 to $6.39. As there is more than one

price with minimum surplus, progress to Principle 3.

Principle 3.

Determine the market pressure. In this

case the surplus of 500 shares is buy surplus at each price. Buy pressure is

denoted by a + sign. In this case, as only buy pressure exists, the auction price

is the highest price in the range of $6.35 to $6.39. Therefore the auction

price is $6.39.

Under

the new and old algorithm the same volume of trades execute and the best bid

and ask remains the same. Brokers 199 and 227 buy 500 shares each at the opening

price and broker 610 sells 1,000 shares at the opening price. The best bid and

ask is left at $6.39, $6.40. However, under the old algorithm all trades

execute at $6.245, while under the new one all trades execute at $6.39.

Therefore, the new algorithm has allowed the price to adjust upwards to reflect

supply and demand.