Session2:

Continuous Market Implementation in ASX

9 April 2013

The

aim of this session is to learn about the representation of trades and to

demonstrate a trading engine that is conformant with a typical market microstructure.

We use some market rules that are typically found in most financial markets.

This session is demonstrated by a simple trading engine tool that simulates ASX

continuous trading market during the normal trading hours.

Pre-requisites

Familiarity

with ASX microstructure; in particular:

- Knowledge

about continuous market microstructure and its implementation in

ASX.

Trading fundamentals and

trading engine software

A

trade corresponds to the exchange of certain volume of securities between a seller

(i.e. the “best ask” order) and a buyer (i.e. the “best bid” order) at the

agreed price. In typical trading, a trade can be executed if a match is

triggered between a seller and a buyer (e.g. when the spread is equal to zero).

The trading process is automated by trading engine software which can

determine and trigger the execution of matched orders trade and calculate the

trading price. Different markets may implement different rules that govern the

order matching criteria and the determination of the trading prices. A trading

engine must implement a matching algorithm that obeys the market

regulations.

In

general terms, the usage of matching algorithms in a trading engine can be summarised as follows:

- Exercise

a corresponding matching algorithm upon receiving certain events (e.g.

receiving a trading order, opening the market, resuming a suspended

security, etc.).

- Different

matching algorithms may exist for different markets and different types of

markets. All matching algorithms are common in that they generate trades

transactions if some buy and sell orders have similar or crossed prices.

They are different from each other in determining when to exercise the

algorithm and the determination of the trading price

Here is a diagram illustrating the trading engine architecture

SIRCA format for representing ASX trades

Like orders, a

trade is represented as a line in a text file with comma separated attributes.

The first line gives the positions of such attributes. We adopt the SIRCA

format uses the following attributes:

|

Instrument |

Date |

Time |

Record Type |

Price |

Volume |

Value |

Trans ID |

Bid ID |

Ask ID |

Bid/Ask |

|

Security |

Date of the order |

Time of the order |

TRADE |

The Price |

The Volume |

The Value |

Transaction ID |

The Bid ID |

The Ask ID |

Bid or ask representaion |

|

String |

date |

date |

String |

Double |

Double |

Double |

Long |

Long |

Long |

String |

Where “record Type”

is the trade that occurred at particular time slot.

Here is a

sample of trade transactions in Sirca’s format

Activity 4

Continuous market

implementation in ASX

In ASX, a continuous market is used during normal

trading hours. Continuous market means that a matching algorithm is exercised

after each corresponding market event. Such events include submitting new

orders and amending existing orders. Normal trading hours is one phase in ASX

trading that we consider in this session. ASX exercises the following matching

algorithm during normal trading hours. The algorithm is typically triggered by

the arrival of a new submit, delete or amend order.

Matching Algorithm

Firstly, each

order receives priority in accordance with the limit price and time of entry.

If the price of a bid (ask) equals or overlaps the best ask (bid), orders will

be automatically traded at successive prices to the extent that stock is

available at the specified limit price. For example, if an order is placed to

buy 100,000 units for 20 cents and the best ask is at 19 cents where there is 50,000 units on offer and a further 25,000 units are

available at 20 cents, the buy order will trade with all units at 19 cents and

25,000 units at 20 cents. The remaining 25,000 units of the buy order will not

be executed but remain on SEATS as a limit buy order at 20 cents depending upon

instructions given to the broker by an investor.

The matching algorithm can be generally described

as follows:

While spread <=

0 do the following:

- Take the best

bid order and best ask orders

- Generate a

trade transaction with the following properties:

i. Volume

traded is the minimum volume of best bid and best ask orders.

ii. The

trading price is determined as:

1.

if spread = 0 then the price is best bid

price (which is also the same as best ask)

if spread

<0 (i.e. overlapping in the orderbook) then the

trading price is the price of the earlier order submitted.

iii. Update

the orderbook as follows:

1.

Remove best bid and best ask orders if both

have the same volume.

2.

Otherwise, remove the order with the

minimum volume (either best bid or best ask) from the orderbook,

and update the volume of the other order

Where

spread=(best ask-best bid)

Let’s examine the following input file:

#Instrument,Date,Time,Record

Type,Price,Volume,Value,Trans ID,Bid

ID,Ask ID,Bid/Ask

AMC,20100401,7:33:26,ENTER,831,500,415500,5044,,8890248881250480000,A

AMC,20100401,7:33:41,ENTER,831,700,581700,5045,,6572914060944080000,A

AMC,20100401,7:34:03,ENTER,832,500,416000,5046,,2420623594072300000,A

AMC,20100401,7:45:35,ENTER,835,500,417500,5047,,11271937057675900000,A

AMC,20100401,7:46:03,ENTER,832,1000,832000,5048,2538037108379030000,,B

AMC,20100401,7:46:24,ENTER,831,500,415500,5049,12651623552247000000,,B

AMC,20100401,7:46:41,ENTER,832,2000,1664000,5050,1606954646700300000,,B

AMC,20100401,7:48:34,ENTER,829,2000,1658000,5051,12072779608763100000,,B

AMC,20100401,7:48:52,ENTER,828,2000,1656000,5052,9502744826424640000,,B

AMC,20100401,7:48:55,ENTER,827,2000,1654000,5053,11747846948127600000,,B

AMC,20100401,7:49:45,ENTER,827,2000,1654000,5054,7226869866406870000,,B

When running

previous matching algorithm in a continuous market, the corresponding trades

file is:

#Instrument,Date,Time,Record Type,Price,Volume,Value,Trans

ID,Bid ID,Ask ID,Bid/Ask

AMC,20100401,7:33:26,ENTER,831,500,415500,5044,,8890250000000000000,A

AMC,20100401,7:33:41,ENTER,831,700,581700,5045,,6572910000000000000,A

AMC,20100401,7:34:03,ENTER,832,500,416000,5046,,2420620000000000000,A

AMC,20100401,7:45:35,ENTER,835,500,417500,5047,,11271900000000000000,A

AMC,20100401,7:46:03,ENTER,832,1000,832000,5048,2538040000000000000,,B

AMC,20100401,7:46:03,TRADE,831,500,415500,5055,2538040000000000000,8890250000000000000,

AMC,20100401,7:46:03,TRADE,831,500,415500,5056,2538040000000000000,6572910000000000000,

AMC,20100401,7:46:24,ENTER,831,500,415500,5057,12651600000000000000,,B

AMC,20100401,7:46:24,TRADE,831,200,166200,5059,12651600000000000000,6572910000000000000,

AMC,20100401,7:46:41,ENTER,832,2000,1664000,5060,1606950000000000000,,B

AMC,20100401,7:46:41,TRADE,832,500,416000,5061,1606950000000000000,2420620000000000000,

AMC,20100401,7:48:34,ENTER,829,2000,1658000,5062,12072800000000000000,,B

AMC,20100401,7:48:52,ENTER,828,2000,1656000,5063,9502740000000000000,,B

AMC,20100401,7:48:55,ENTER,827,2000,1654000,5064,11747800000000000000,,B

AMC,20100401,7:49:45,ENTER,827,2000,1654000,5065,7226870000000000000,,B

Notice how a

continuous market is implemented which examines the existence of a trade after

each submission of an order. For example, the first trade is generated just

after a buy order with ID=2538037108379030000 is submitted at the price=832.0

and volume=1000 that makes it a best bid order with spread=-1. The trade

counterpart in this example is ask

ID=8890248881250480000 which is standing at the best ask. Since both orders

have the same price, they are both removed from the orderbook

by the time this trade is generated.

After processing all the order transactions, the orderbook looks as follows:

ORDERBOOK FOR

SECURITY AMC - BEGIN

Best bid=832.0,

Best ask=835.0

Ask[5047], 835.0,

vol:500.0, [11271937057675900000]

<--spread=3.0-->

Bid[5060], 832.0,

vol:1500.0, [1606954646700300000]

Bid[5057], 831.0,

vol:300.0, [12651623552247000000]

Bid[5062], 829.0,

vol:2000.0, [12072779608763100000]

Bid[5063], 828.0,

vol:2000.0, [9502744826424640000]

Bid[5064], 827.0,

vol:2000.0, [11747846948127600000]

Bid[5065], 827.0,

vol:2000.0, [7226869866406870000]

ORDERBOOK FOR

SECURITY AMC - END

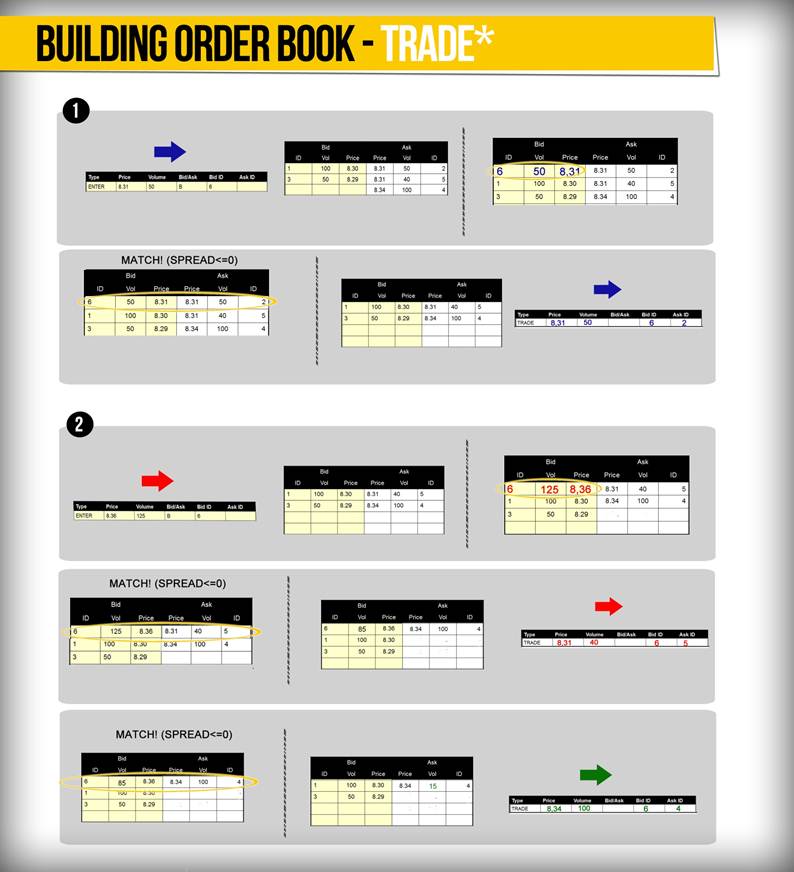

Figure 1

illustrates another example of generating trades.

Figure

1: Example of an order generating (1) one trade (2) two trades